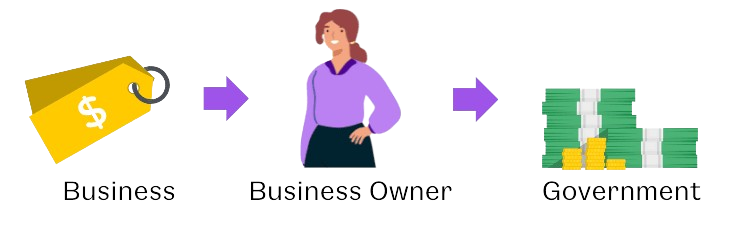

Limited Partnerships are also considered as “pass-through entities'. This essentially means that businesses that fall under a limited partnership can avoid double taxation at the corporate and personal level on the same source of income and can only be taxed once. As a pass-through business entity, partners in a partnership are able to withdraw or deduct from their business income based on a percentage. Income is not held in the partnership but instead in each partner’s funds.